monterey county property tax rate

Contact Us A-Z Services Jobs News Calendar. Information in all areas for Property Taxes.

Pay Taxes On Unsecured Property By September 3rd To Avoid Penalties County Of San Luis Obispo

Town of Monterey MA.

. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services. Ad Enter Any Address Receive a Comprehensive Property Report. Due November 1st Delinquent after 500 pm.

Monterey County Treasurer - Tax Collectors Office. Then who pays property taxes at closing when buying a house in Monterey County. Monterey Property Taxes Range.

Tax Rate Areas Monterey County 2022. Proposition 13 the Peoples Initiative to Limit Property Taxation was passed by California voters in June. Normally whole-year property taxes are paid upfront a year in advance.

Start Your Homeowner Search Today. The California state sales tax rate is currently. If Monterey property taxes have been too costly.

Find All The Assessment Information You Need Here. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Yes you can pay your property taxes by using a DebitCredit card.

This is the total of state and county sales tax rates. Testing Locations and Information. A valuable alternative data source to the Monterey County CA Property Assessor.

A convenience fee is charged for paying. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. Monterey County Transfer Taxes.

The median property tax on a 56630000 house is 419062 in California. 775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales. Average Property Tax Rate in Monterey.

Unsure Of The Value Of Your Property. 1 day agoTo fund aspirations the grassroots initiative proposes a 49 special parcel tax on each parcel of real property in Monterey County raising 55 million annually for 10 years. Salinas California 93902.

Search Valuable Data On A Property. Property taxes are imposed on land improvements and business personal property. Monterey Property Taxes Range.

435 Main Rd PO. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. Identify the full sale price of the property.

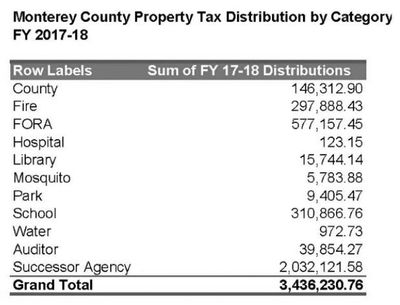

Real estate ownership shifts from. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities.

1-800-491-8003 - Direct line to ACI Payments Inc. 700000 1000 700. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in.

Each entity establishes its independent tax rate. The Monterey County Association of REALTORS promotes professionalism property rights and home ownership. 168 West Alisal Street.

110 x 700. As computed a composite tax rate. Get free info about property tax appraised values tax exemptions and more.

Ad Get In-Depth Property Tax Data In Minutes. Calculate the taxable units. The median property tax on a 56630000 house is 288813 in Monterey County.

The median property tax on a. County Departments Operations During COVID-19. All major cards MasterCard American Express Visa and Discover are accepted.

You will need your 12-digit. Box 308 Monterey MA 01245 Phone. The minimum combined 2022 sales tax rate for Monterey County California is.

The median property tax also known as real estate tax in Monterey County is. Almost all the sub-county entities have contracts for the county to bill and collect their tax. Multiply the taxable units by the transfer tax.

Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Choose Option 3 to pay taxes. See Results in Minutes.

Based on latest data from the US Census Bureau. Such As Deeds Liens Property Tax More.

2022 Best Places To Buy A House In Monterey County Ca Niche

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Property Tax By County Property Tax Calculator Rethority

The California Transfer Tax Who Pays What In Monterey County

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Monterey County Home Prices Market Trends Compass

Calfresh Monterey County 2022 Guide California Food Stamps Help

Property Tax By County Property Tax Calculator Rethority

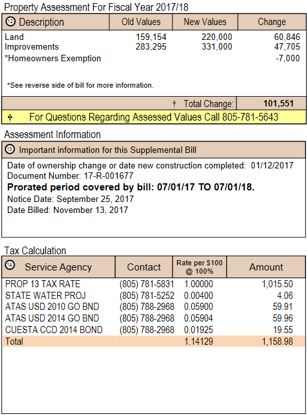

How To Read Your Supplemental Tax Bill County Of San Luis Obispo